What are my voting choices when voting on the advisory (non-binding) proposal approving the Company’s 20102012 executive compensation as described in this Proxy Statement?

Shareholders may:

| |

| (a) | Vote FOR the proposal; |

| |

| (b) | Vote AGAINST the proposal; or |

| |

| (c) | ABSTAIN from voting on the proposal. |

(a) Vote FOR the proposal;

(b) Vote AGAINST the proposal; or

(c) ABSTAIN from voting on the proposal.

What are my voting choices when voting on the advisory (non-binding) proposal to determine whether the shareholder advisory vote to approve the Company’s executive compensation should occur every one, two or three years?

Shareholders may:

(a) Vote for holding an advisory (non-binding) vote to approve the Company’s executive compensation every ONE year;

(b) Vote for holding an advisory (non-binding) vote to approve the Company’s executive compensation every TWO years;

(c) Vote for holding an advisory (non-binding) vote to approve the Company’s executive compensation every THREE years; or

(d) ABSTAIN from voting on the proposal.

What are my voting choices when voting on the ratification of the Audit Committee’s selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2011?2013?

Shareholders may:

(a) | |

| (a) | Vote FOR the ratification; |

| |

| (b) | Vote AGAINST the ratification; or |

| |

| (c) | ABSTAIN from voting on the ratification. |

2

(b) Vote AGAINST the ratification; or

(c) ABSTAIN from voting on the ratification.

What are the Board’s recommendations?

The Board recommends a vote:

| • | | FOR the election of each of the thirteen Director nominees named in this Proxy Statement; |

|

| • | | FOR the proposal to amend the Company’s 2007 Plan to (i) increase the number of shares that may be offered under the plan by 2,860,000, and (ii) re-approve the material terms of the performance measures for the 2007 Plan, in accordance with Section 162(m) of the Code; |

|

| • | | FOR the advisory (non-binding) proposal approving the Company’s 2010 executive compensation as described in this Proxy Statement; |

|

| • | | FOR the advisory (non-binding) proposal to hold an advisory vote to approve the Company’s executive compensation every year; and |

|

| • | | FOR the ratification of the Audit Committee’s selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2011. |

FOR the advisory (non-binding) proposal approving the Company’s 2012 executive compensation as described in this Proxy Statement; and

FOR the ratification of the Audit Committee’s selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2013.

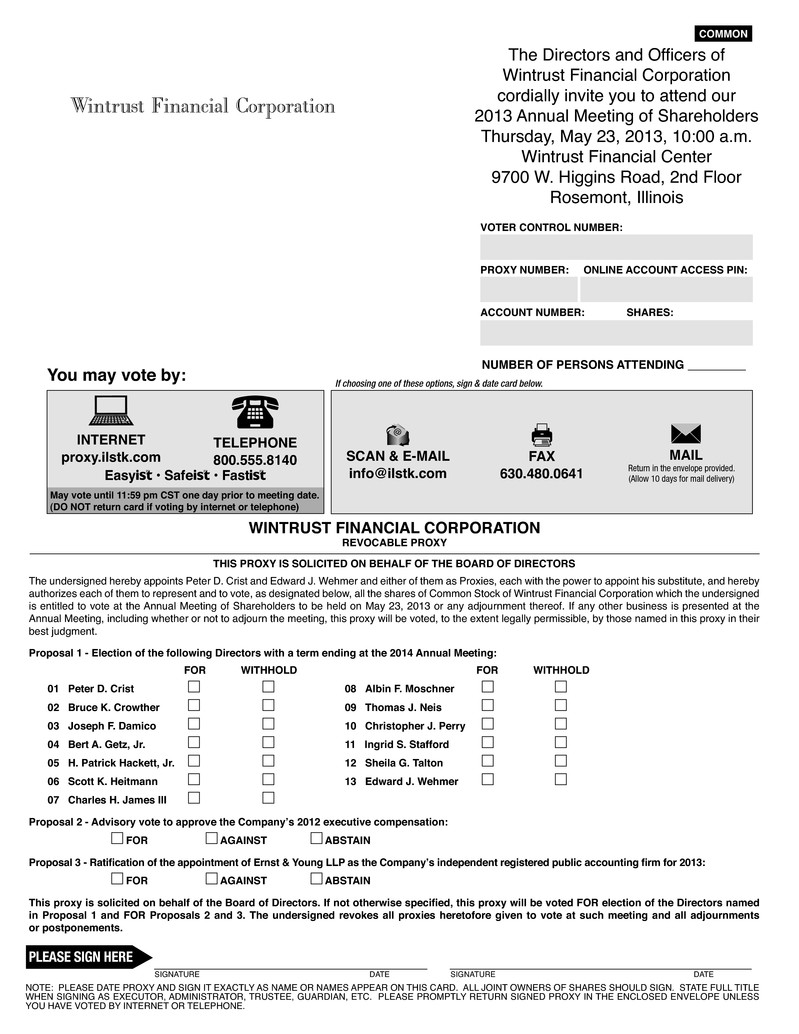

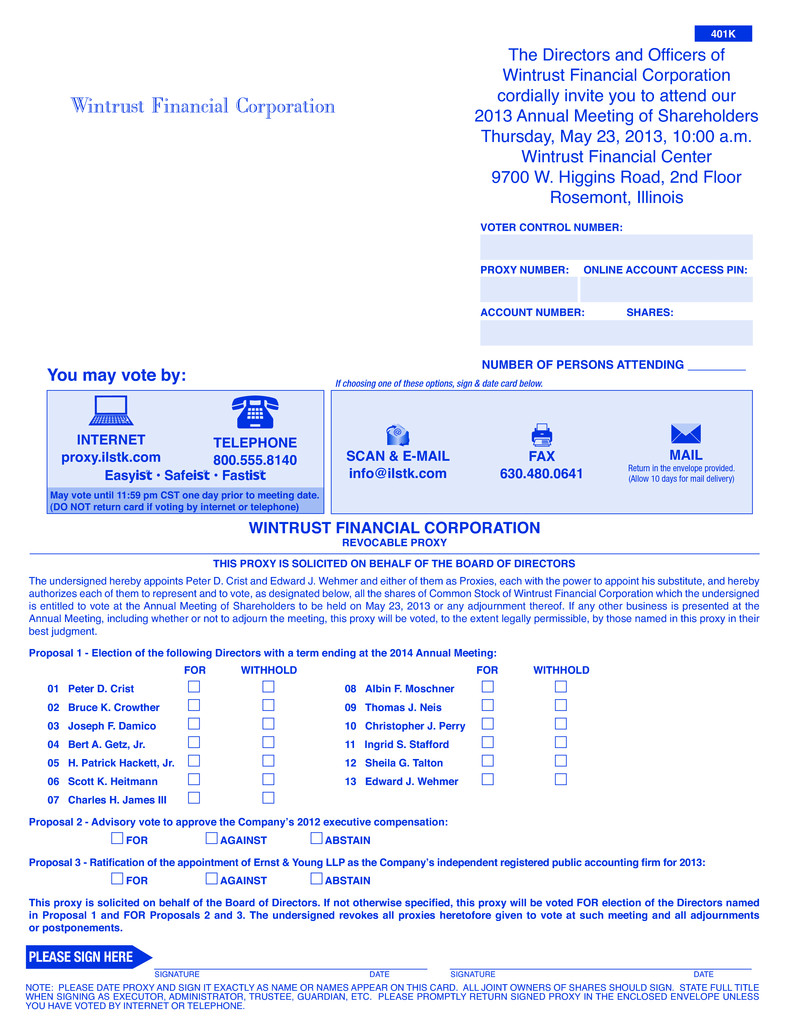

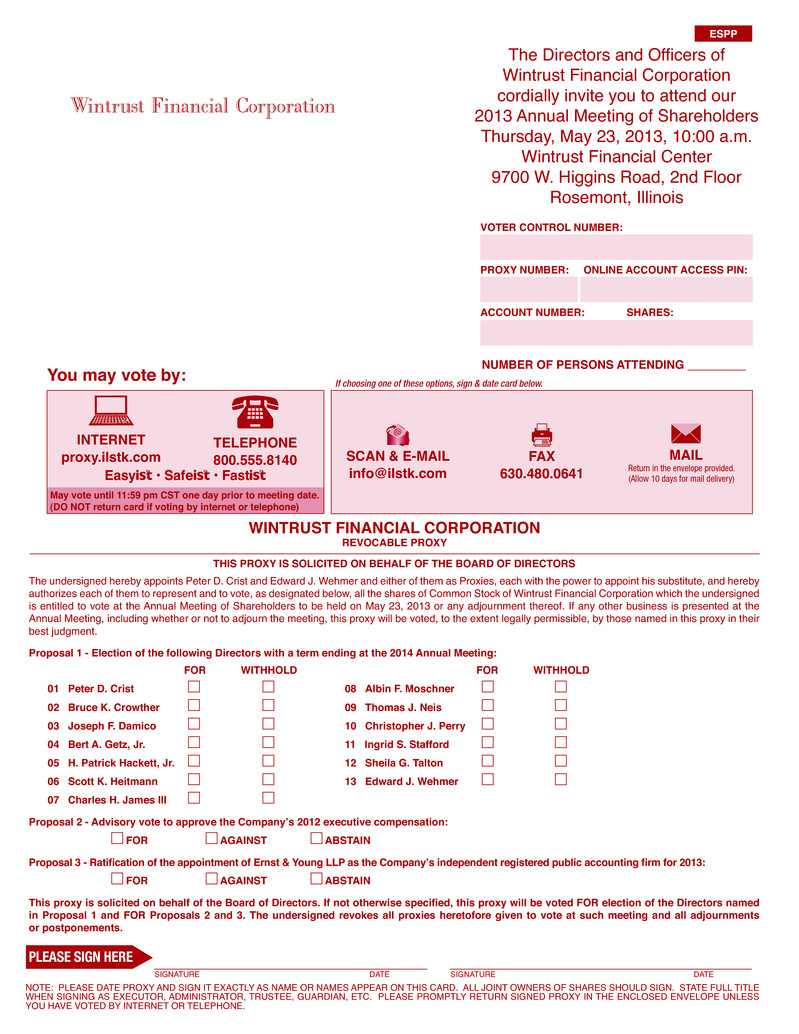

How will my shares be voted if I sign, date and return my proxy card?

If you sign, date and return your proxy card and indicate how you would like your shares voted, your shares will be voted as you have instructed. If you sign, date and return your proxy card but do not indicate how you would like your shares voted, your proxy will be voted:

FOR the election of each of the thirteen Director nominees named in this Proxy Statement;

3

| • | | FOR the proposal to amend the Company’s 2007 Plan to (i) increase the number of shares that may be offered under the plan by 2,860,000,FOR the advisory (non-binding) proposal approving the Company’s 2012 executive compensation as described in this Proxy Statement; and (ii) re-approve the material terms of the performance measures for the 2007 Plan, in accordance with Section 162(m) of the Code; |

|

| • | | FOR the advisory (non-binding) proposal approving the Company’s 2010 executive compensation as described in this Proxy Statement; |

|

| • | | FOR the advisory (non-binding) proposal to hold an advisory vote to approve the Company’s executive compensation every year; and |

|

| • | | FOR the ratification of the Audit Committee’s selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2011. |

FOR the ratification of the Audit Committee’s selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2013.

With respect to any other business that may properly come before the meeting, or any adjournment of the meeting, that is submitted to a vote of the shareholders, including whether or not to adjourn the meeting, your shares will be voted in accordance with the best judgment of the persons voting the proxies.

How will broker non-votes be treated?

A broker non-vote occurs when a broker who holds its customer’s shares in street name submits proxies for such shares, but indicates that it does not have authority to vote on a particular matter. Generally, this occurs when brokers have not received any instructions from their customers. In these cases, the brokers, as the holders of record, are permitted to vote on “routine” matters only, but not on other matters. In this Proxy Statement, brokers who have not received instructions from their customers would only be permitted to vote on theon:

The ratification of the appointment of Ernst & Young LLP.

Brokers who have not received instructions from their customers would not be permitted to vote on the following proposals:

| • | | To elect the thirteen Director nominees named in this Proxy Statement; |

|

| • | | To amend the Company’s 2007 Plan to (i) increase the number of shares that may be offered under the plan by 2,860,000, and (ii) re-approve the material terms of the performance measures for the 2007 Plan, in accordance with Section 162(m) of the Code; |

|

| • | | The advisory (non-binding) proposal approving the Company’s 2010 executive compensation as described in this Proxy Statement; and |

|

| • | | The advisory (non-binding) proposal to hold an advisory vote to approve the Company’s executive compensation every year. |

The advisory (non-binding) proposal approving the Company’s 2012 executive compensation as described in this Proxy Statement.

We will treat broker non-votes as present to determine whether or not we have a quorum at the Annual Meeting, but they will not be treated as entitled to vote on the proposals, if any, for which the broker indicates it does not have discretionary authority.

How will abstentions or withheld votes be treated?

If you vote to abstain or withhold authority to vote, your shares will be counted as present to determine whether or not we have a quorum at the Annual Meeting. If you withhold authority to vote for one or more of the nominees for director, this will have the same effect as a vote against such nominee.

If you abstain from voting on the following proposals,advisory (non-binding) proposal approving the Company’s 2012 executive compensation as described in this Proxy Statement, your abstention will have the same effect as a vote against such proposal:the proposal.

| • | | To amend the Company’s 2007 Plan to (i) increase the number of shares that may be offered under the plan by 2,860,000, and (ii) re-approve the material terms of the performance measures for the 2007 Plan, in accordance with Section 162(m) of the Code; |

|

| • | | The advisory (non-binding) proposal approving the Company’s 2010 executive compensation as described in this Proxy Statement; and |

|

| • | | Ratification of the Audit Committee’s selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2011. |

4

If you abstain from voting on the advisory (non-binding) proposal to hold an advisory vote to approveratification of the Company’s recommendation to approve executive compensation every year,Audit Committee’s selection of Ernst & Young LLP as Wintrust’s independent registered public accounting firm for 2013, your abstention will have nothe same effect onas a vote against the frequency that is selected by shareholders.proposal.

What vote is required to elect Directors at the Annual Meeting?

Election as a Director of the Company requires that a nominee receive the affirmative vote of a majority of the shares of Common Stock represented at the Annual Meeting, in person or by proxy, and entitled to vote thereon. Accordingly, instructions to withhold authority will have the same effect as a vote against such nominee.

What vote is required to amend the Company’s 2007 Plan to (i) increase the number of shares that may be offered under the plan by 2,860,000, and (ii) re-approve the material terms of the performance measures for the 2007 Plan, in accordance with Section 162(m) of the Code?

The approval of the amendment to the 2007 Plan requires the affirmative vote of a majority of the shares of Common Stock represented at the Annual Meeting, in person or by proxy, and entitled to vote thereon. Abstentions will have the same effect as a vote against the proposal.

What vote is required to approve the advisory (non-binding) proposal approving the Company’s 20102012 executive compensation as described in this Proxy Statement?

The approval of the advisory (non-binding) proposal on the Company’s 20102012 executive compensation described in this Proxy Statement requires the affirmative vote of a majority of the shares of Common Stock represented at the Annual Meeting, in person or by proxy, and entitled to vote thereon. Abstentions will have the same effect as a vote against the proposal.

What vote is required to approve the advisory (non-binding) proposal to determine whether the shareholder advisory vote to approve the Company’s executive compensation should occur every one, two or three years?

The option of one year, two years or three years that receives the highest number of votes cast by shareholders will be considered by the Company as the shareholders’ recommendation as to the frequency of future advisory votes to approve the Company’s executive compensation. Abstentions will have no effect on the frequency that is selected by shareholders.

What vote is required to ratify the Audit Committee’s selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2011?2013?

Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 20112013 requires the affirmative vote of a majority of the shares of Common Stock represented at the Annual Meeting, in person or by proxy, and entitled to vote thereon. Abstentions will have the same effect as a vote against ratification.

What if other matters come up during the Annual Meeting?

If any matters other than those referred to in the Notice of Annual Meeting properly come before the Annual Meeting, the individuals named in the accompanying form of proxy will vote the proxies held by them in accordance with their best judgment. The Company is not aware of any business other than the items referred to in the Notice of Annual Meeting that may be considered at the Annual Meeting.

Your vote is important. Because many shareholders cannot personally attend the Annual Meeting, it is necessary that a large number be represented by proxy. Whether or not you plan to attend the meeting in person, prompt voting will be appreciated. Registered shareholders can vote their shares via the Internet or by using a toll-free telephone number. Instructions for using these convenient services are provided on the proxy card. Of course, you may still vote your shares on the proxy card. To do so, we ask that you complete, sign, date and return the enclosed proxy card promptly in the postage-paid envelope.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Shareholders to be Held on May 26, 2011:23, 2013:

This Proxy Statement and the 20102012 Annual Report on Form 10-K are Available at:

https://materials.proxyvote.com/97650W

5

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

The Company’s Board of Directors is comprised of 13 Directors, each serving a term that will expire at this year’s Annual Meeting. At the Annual Meeting, you will elect 13 individuals to serve on the Board of Directors until the next Annual Meeting. The Board of Directors, acting pursuant to the recommendation of the Nominating and Corporate Governance Committee, has nominated each Director standing for election. AllEach of the nominees currently serveserves as Directors.a Director. Each nominee has indicated a willingness to serve, and the Board of Directors has no reason to believe that any of the nominees will not be available for election. However, if any of the nominees is not available for election, proxies may be voted for the election of other persons selected by the Board of Directors. Proxies cannot, however, be voted for a greater number of persons than the number of nominees named. Shareholders of the Company have no cumulative voting rights with respect to the election of Directors.

The following sections set forth the names of the Director nominees, their ages, a brief description of their recent business experience, including recent occupation and employment, certain directorships held by each, certain experiences, qualifications, attributes and skills, and the year in which they became Directors of the Company. Director positions in the Company’s subsidiaries are included in the biographical information set forth below.

The Company’s main operating subsidiaries include Advantage Bank, Barrington Bank & Trust Company, N.A., Beverly Bank Chicago& Trust Company, N.A., Crystal Lake Bank & Trust Company, N.A., First Insurance Funding Corporation, Great Lakes Advisors, LLC, Hinsdale Bank & Trust Company, Lake Forest Bank & Trust Company, Libertyville Bank & Trust Company, North Shore Community Bank & Trust, Northbrook Bank & Trust Company, Old Plank Trail Community Bank, N.A., Schaumburg Bank & Trust Company, N.A., State Bank of Thethe Lakes, St. Charles Bank Tricom, Town Bank, Village Bank, Wayne Hummer Investments, Wheaton Bank, Wintrust Information Technology Services, Wintrust Capital Management and Wintrust Mortgage Company.& Trust Company, The Chicago Trust Company, N.A., Town Bank, Tricom, Inc. of Milwaukee, Village Bank & Trust, Wayne Hummer Investments, L.L.C., and Wintrust Capital Management areWheaton Bank & Trust Company.

We refer to The Chicago Trust Company, N.A., Great Lakes Advisors, LLC and Wayne Hummer Investments, LLC collectively referred to herein as Wintrust Wealth Management.

Nominees to Serve as Directors until the 20122013 Annual Meeting of Shareholders

Peter D. Crist (59)(61), Director since 1996.Mr. Crist has served as the Company’s Chairman since 2008. Mr. Crist founded Crist Kolder Associates, an executive recruitment firm which focuses on chief executive officer and director searches, in 2003 and has served since inception as its Chairman and Chief Executive Officer. From December 1999 to January 2003, Mr. Crist served as Vice Chairman of Korn/Ferry International (NYSE), the largest executive search firm in the world. Previously, he was President of Crist Partners, Ltd., an executive search firm he founded in 1995 and sold to Korn/Ferry International in 1999. Immediately prior thereto he was Co-Head of North America and the Managing Director of the Chicago office of Russell Reynolds Associates, Inc., the largest executive search firm in the Midwest, where he was employed for more than 18 years. He also serves as a director and chairman of the compensation committee of Northwestern Memorial Hospital and as a director of Northwestern Memorial HealthCare. Mr. Crist is a Director of Hinsdale Bank.

Mr. Crist’s experience assisting companies with executive searches provides him with insight into the attraction and retention of Company personnel, an important concern of the Company. In addition, Mr. Crist’s experience as an executive of several large, Chicago-based businesses provides him with insight into the management and operational challenges and opportunities facing the Company in its markets. He also brings experience as a memberthe chair of the compensation committee of Northwestern Memorial Hospital. In addition, Mr. Crist’s experience as a director of a Hinsdale Bank gives him valuable insight into the Company’s banking operations.

Bruce K. Crowther (59)(61), Director since 1998.Mr. Crowther has served as President and Chief Executive Officer of Northwest Community Healthcare, Northwest Community Hospital and certain of its affiliates since January 1992. Prior to that time he served as Executive Vice President and Chief Operating Officer from 1989 to 1991. He is a Fellow of the American College of Healthcare Executives. Mr. Crowther is the past Chairman of the board of directors of the Illinois Hospital Association as well as a member of the board of directors of the Max McGraw Wildlife Foundation. Mr. Crowther is a Director of Barrington Bank.

Mr. Crowther’s experience as President and Chief Executive officerOfficer of Northwest Community Healthcare, Northwest Community Hospital and certain of its affiliates provides him with insight into the challenges of leading a large and complex organization in the greater Chicago area and an understanding of the operation and management of a large business. In addition, Mr. Crowther’s experience as a director of Barrington Bank gives him valuable insight into the Company’s banking operations.

6

Joseph F. Damico (57)(59), Director since 2005.Mr. Damico is a founding partner and Co-Chairman of RoundTable Healthcare Partners, an operating-oriented private equity firm focused on the healthcare industry. Mr. Damico has more than

30 years of healthcare industry operating experience, previously as Executive Vice President of Cardinal Health, Inc. and President &and Chief Operating Officer of Allegiance Corporation. Mr. Damico also held senior management positions at Baxter International Inc. and American Hospital Supply and serves as a Director of Northwestern Memorial Hospital and James Madison University. Mr. Damico is an advisory Director of Libertyville Bank.

Mr. Damico’s experience in senior leadership positions with Cardinal Health, Allegiance, Baxter International, and American Hospital Supply provides him with knowledge of the issues faced by large and complex businesses. In addition, his experience as Co-Chairman of RoundTable Healthcare Partners provides him with insight into issues faced by entrepreneurial companies. His experience as a corporate director also provides him with knowledge of the operations of various boards of directors. Mr. Damico’s experience as an advisory director of Libertyville Bank gives him valuable insight into the Company’s banking operations.

Bert A. Getz, Jr. (43)(45), Director since 2001.Mr. Getz joined Globe Corporation in 1991 and serves as Director and Co-Chief Executive Officer. He is also President of Globe Development Corporation (a wholly-owned real estate development subsidiary of Globe Corporation), an Officer and Director of Globe Management Company, and Chairman of the Investment Committee for Globe Investment Company, LP. Additionally, Mr. Getz is a Director of the Globe Foundation, the National Historical Fire Foundation and Children’s Memorial Hospital, and is a Trustee of the Chicago Zoological Society at Brookfield Zoo, The Lawrenceville School and North Shore Country Day School. Mr. Getz serves as a Director of Great Lakes Advisors, Libertyville Bank, Wintrust Capital Management, Wayne Hummer Investments and The Chicago Trust Company.

Mr. Getz’s experience in real estate investment and development, through Globe Corporation and its affiliates, provides him with knowledge of the real estate market in the Chicago area, which affects numerous aspects of the Company’s business, particularly the Company’s lending operations. In addition, Mr. Getz’s experience as a real estate developer provides insight into the operation of credit-intensive businesses. His experience as a director of various corporate and non-profit boards provide him with knowledge of the concerns of various constituencies of the Company. As a result of his financial experience, Mr. Getz qualifies as a financial expert for purposes of rules governing audit committees. In addition, Mr. Getz’s experience as a director of Libertyville Bank and Wintrust Wealth Management gives him valuable insight into the Company’s banking, brokerage and investment advisory operations.

H. Patrick Hackett, Jr. (59)(61), Director since 2008.Mr. Hackett is the Principal of HHS Co., a real estate development and management company located in the Chicago area. Previously, he served as the President and Chief Executive Officer of RREEF Capital, Inc. and as Principal of The RREEF Funds, an international commercial real estate investment management firm. Mr. Hackett taught real estate finance at the Kellogg Graduate School of Management for 15 years when he also served on the real estate advisory boards of Kellogg and of the Massachusetts Institute of Technology. He serves on the board of First Industrial Realty Trust, Inc. (NYSE) and is a director of North Shore Community Bank.

Mr. Hackett’s experience as Principal of HHS Co. provides him deep familiarity with knowledge of thefinancial modeling and underwriting approaches toward valuing corporate and bank acquisitions, as well as commercial real estate, market in the Chicago area, a market which impacts not only the value ofoften serves as collateral pledged to the Company, but also affects demand for the Company’s lending products. In addition, Mr. Hackett’s 25 years of experience reviewing and analyzing commercial real estate investments for registered investment advisors provides him with knowledge of financial analysis and modeling of commercial real estate transactions as well as the investment committee process. Mr. Hackett’s experience as a director of North Shore Community Bank givesand as a bank auditor, early in his career, give him valuable insight into the Company’s banking operations.

Scott K. Heitmann (62)(64), Director since 2008.Mr. Heitmann, retired for the past sixeight years, has over 30 years of experience in the banking industry, including his service as Vice Chairman of LaSalle Bank Corporation and President, Chairman and Chief Executive Officer of Standard Federal Bank from 1997 to 2005. He served as the President and Chief Executive Officer of LaSalle Community Bank Group and LaSalle Bank FSB from 1988 to 1996. Mr. Heitmann currently serves as a member of the board of The Illinois Chapter of The Nature Conservancy, and as an Advisory Director of Boys Hope Girls Hope of Illinois. Mr. Heitmann has previously served as a director of LaSalle Bank Corporation, Standard Federal Bank and the Federal Home Loan Bank of Chicago. Mr. Heitmann is a Director of Great Lakes Advisors, North Shore Community Bank, Wintrust Capital Management, Wayne Hummer Investments and The Chicago Trust Company.

7

Mr. Heitmann’s experience in the banking industry, including service in executive leadership roles at LaSalle Bank and Standard Federal Bank, provide him with knowledge of the financial services business, generally, and the business of community banking, in particular. His experience as a former bank lender also provides insight into the Company’s community banking business. In addition, his experience with LaSalle Bank’s various predecessors provides him with insight into the opportunities and challenges posed to a growth-oriented Chicago-based community bank. As a result of his financial experience, Mr. Heitmann qualifies as a financial expert for purposes of rules governing audit committees. Mr. Heitmann’s experience as a director of North Shore Community Bank and Wintrust Wealth Management gives him valuable insight into the Company’s banking, brokerage and investment advisory operations.

Charles H. James III (52)(54), Director since 2008.Mr. James is the Chairman and Chief Executive Officer of C.H. James & Co., an investment holding company with interests in wholesale food distribution businesses, and is Managing Owner of C.H. James Restaurant Holdings LLC, which owns quick service restaurants. From 2001 to 2003 Mr. James served as Chairman of the Board and Chief Executive Officer of PrimeSource Foodservice Equipment, Inc., a food service equipment and supplies distributor that specializes in servicing quick service restaurant chains and multi-unit operators. Mr. James also serves on the board of directors of Summit Housing Partners, Morehouse College, and the Children’s Memorial Hospital.College. Mr. James is a Director of Lake Forest Bank.

Mr. James’s experience as Chairman and Chief Executive Officer of C.H. James & Co. and Managing Owner of C.H. James Restaurant Holdings provides him with knowledge of businesses engaged in both wholesale distribution and consumer sales, each an important segment of the Company’s customer base. As a chief executive, Mr. James also brings substantial operational and management experience to the Board. In addition, Mr. James’ experience as a director of Lake Forest Bank gives him valuable insight into the Company’s banking operations.

Albin F. Moschner (58)(60), Director since 1996.Mr. Moschner is currently a consultant in the wireless industry and recently retired from the position of Executive Vice President and Chief Operating Officer of Leap Wireless. He joined Leap Wireless in 2004 as the Chief Marketing Officer. In the eight years prior to joining Leap Wireless, Mr. Moschner held executive positions in both early stage and corporate, internet and telecommunications companies as President of Verizon Card Services, President and Chief Executive Officer of One Point Services and Vice-Chairman of Diba, Inc. Mr. Moschner also served as Director, Chief Operating Officer and President and Chief Executive Officer of Zenith Electronics, Glenview, Illinois, from 1991 to 1996. Mr. Moschner serves on the Board of Directors of USA Technologies, Inc. (NASDAQ).

Mr. Moschner’s experience as President and Chief Executive Officer of Zenith Electronics provides him with insight into the management of a public company. Mr. Moschner’s experience in the telecommunications industry also provides him with insight into the challenges and opportunities of businesses undergoing secular change. As a result of his financial experience, Mr. Moschner qualifies as a financial expert for purposes of rules governing audit committees.

Thomas J. Neis (62)(64), Director since 1999.Mr. Neis is the owner of Neis Insurance Agency, Inc., QR Insurance Agency and Pachini Insurance Agency and is an independent insurance agent with these companies. Mr. Neis also owns Parr Insurance Brokerage Inc., marketing insurance products to insurance agencies. Through QR Insurance Agency, he provides insurance consulting for banking and financial institutions. Mr. Neis is a member of the Board of Trustees of Illinois Wesleyan University, where he serves on its Audit, Investment and Business Affairs committees. In addition, Mr. Neis is a member of the university’s national alumni board and served as past president of the university’s Chicago Alumni Board. He also founded and chaired the Crystal Lake Sister City organization with Holtzgerlingen, Germany and has been active in several other charitable and fraternal organizations. Mr. Neis is a Director of Crystal Lake Bank.

Mr. Neis has experience in the insurance industry, which, through the Company’s premium finance receivable financing business, impacts a substantial and growing portion of the Company’s business. Through his insurance businesses, Mr. Neis also has experience operating in an industry with multiple layers of regulation. In addition, Mr. Neis’ experience as a director of Crystal Lake Bank gives him valuable insight into the Company’s banking operations.

Christopher J. Perry (55)(57), Director since 2009.Mr. Perry is currently a partner at CIVC Partners LLC, a private equity investment firm which he joined in 1994 after leading Continental Bank’s Mezzanine Investments and Structured Finance groups. Prior to joining Continental in 1985, he served as a Vice President in the Corporate Finance Department of the Northern Trust Company. He has been in the financial services industry for the past 25 years. During his time at CIVC Partners, he has served on the boards of over a dozen public and private companies. He serves as chairman of the Board of Trustees for Cristo Rey Jesuit High School and serves on the

8

Executive Committee of Loyola Academy. Mr. Perry previously served as a director of Wintrust from 2001 to 2002. An affiliate of CIVC Partners LLC owns all of Wintrust’s 8.00% Non-Cumulative Perpetual Convertible Preferred Stock, Series A, as described under “Related Party Transactions.”

Mr. Perry’s role as a partner of CIVC Partners gives him insight into a broad range of privately held companies across a number of industries, including financial services. In addition, his experience as a leader at CIVC, Continental Bank’s Mezzanine Investments Group and Structured Finance Group gives him insight into complex capital structures, financial instruments and all aspects of transactions. Mr. Perry’s over two decades of experience in the financial services industry have given him considerable experience in many aspects of the industry during several credit and economic cycles.

Hollis W. Rademacher (75), Director since 1996.Mr. Rademacher is self-employed as a business consultant and private investor. From 1957 to 1993, Mr. Rademacher held various positions, including Officer in Charge, U.S. Banking Department and Chief Credit Officer of Continental Bank, N.A., Chicago, Illinois, and from 1988 to 1993 held the position of Chief Financial Officer. Mr. Rademacher is also a director of Schawk, Inc. (NYSE), a provider of prepress graphics for the packaging industry. Mr. Rademacher currently serves as a Director of each of the Company’s main operating subsidiaries except for Beverly Bank, Old Plank Trail Community Bank, St. Charles Bank, Town Bank, Wheaton Bank, Wintrust Information Technology Services, Wintrust Capital Management, Wayne Hummer Investments, The Chicago Trust Company and Wintrust Mortgage Corporation.

Mr. Rademacher’s experience as a credit officer and chief financial officer of Continental Bank provide insight into the credit decision-making process, one of the Company’s core competencies. In addition, as noted above, Mr. Rademacher is a member of the board of most of the Company’s bank subsidiaries for which, in most cases, he serves as chair of such bank’s credit or risk management committee. As such, Mr. Rademacher has substantial experience with the Company’s banking business, including the management of the risks of that business. In addition, Mr. Rademacher’s experience as director of various publicly-traded companies provides him with knowledge of board operations. In addition, Mr. Rademacher’s experience as a director of Wintrust Wealth Management gives him valuable insight into the Company’s brokerage, investment advisory, and trust services operations.

Ingrid S. Stafford (57)(59), Director since 1998.Ms. Stafford has held various positions since 1977 with Northwestern University, where she is currently Associate Vice President for Financial Operations and Treasurer. Ms. Stafford is a trustee of the Board of Pensions of the Evangelical Lutheran Church in America, where she serves on its Executive, Finance and Nominating Committees and is Chair of its Audit Committee. She also serves on the investment committee of Wittenberg University and the investment and audit committees of the Evanston Community Foundation. She is an emeritus director of Wittenberg University where she served from 1993 to 2006, including serving as Board Chair from 2001-2005. Ms. Stafford is a Director of North Shore Community Bank.

Ms. Stafford’s experience as Associate Vice President for Financial Operations and Treasurer of Northwestern University provides experience with the management of the liquidity, financial reporting, risk and audit management of a large organization. She serves in a management support role to its Board of Trustees’ Audit, Finance and Investment Committees. In addition, as a member of the investment committees of Wittenberg University and the Evanston Community Foundation, she has experience with investment strategy and asset allocation. She also has concurrent experience as an audit committee member and chair of the Board of Pensions of the Evangelical Lutheran Church in America (now known as Portico Benefit Services) and the Evanston Community Foundation.audit committee member of Wittenberg University. As a result of her financial experience, Ms. Stafford qualifies as a financial expert for purposes of rules governing audit committees. In addition, Ms. Stafford’s experience as a director of North Shore Community Bank gives her valuable insight into the Company’s banking operations.

Sheila G. Talton (60), Director since 2012. Ms. Talton is President of SGT, Ltd., a firm that provides strategy and technology consulting services in global markets in the financial services, healthcare and technology business sectors. Prior to that time, she served as Vice President, Office of Globalization, for Cisco Systems, Inc., a leading global manufacturer, supplier and servicer of Internet Protocol (IP)-based networking and other products related to the communication and information technology industry, and held that position from 2008 to July, 2011. From 2004 to 2008 she also held vice president positions of Cisco’s Advisory Services Consulting Group and China groups following a long career in the information technology industry. Prior to joining Cisco Ms. Talton served in multiple roles at Cap Gemini and EDS including as President of their Business Process Innovation Global Consulting Practice. Ms. Talton serves on the Board of Directors of ACCO Brands Corp. (NYSE).

Ms. Talton’s extensive knowledge of information technology systems and technology security issues permit her to provide guidance on critical issues to the Company’s successful growth. Ms. Talton’s experience in technology systems provides her with insight into the challenges of securely providing a diverse client base with a broad array of financial services. In addition, her experience in senior leadership with Cisco Systems provides her with knowledge of the issues faced by large and complex businesses. Ms. Talton also brings substantial operational and management experience to the board.

Edward J. Wehmer (57)(59), Director since 1996.Mr. Wehmer, a founder of the Company, has served since May 1998 as President and Chief Executive Officer of the Company. Prior to May 1998, he served as President and Chief Operating Officer of the Company since its formation in 1996. He served as the President of Lake Forest Bank from 1991 to 1998. He serves as an Advisory Director of each of the Company’s main operating subsidiaries. Mr. Wehmer is a certified public accountant and earlier in his career spent seven years with the accounting firm of Ernst & Young LLP specializing in the banking field and particularly in the area of bank mergers and acquisitions. Mr. Wehmer serves on the board of directors of Stepan Company (NYSE), a chemical manufacturing and distribution company. He also serves as a director of Northwestern Lake Forest Hospital and the Catholic Extension Society, on the audit committee of Northwestern Memorial Health Care, as a trustee for Children’s Memorial

9

Hospital and Foundation, as a member of the advisory board of the Farmer School of Business of Miami University, and on the Finance Board and the School Board of the Archdiocese of Chicago.

Mr. Wehmer is the only member of the Board who is also a manager of the Company. As such, he provides the views of the management of the Company and substantial insight into the operations of the Company. As an employee of the Company since its inception, he also provides historical context for the Board’s discussions.

Required Vote

Election as a Director of the Company requires that a nominee receive the affirmative vote of a majority of the shares of Common Stock represented at the Annual Meeting, in person or by proxy, and entitled to vote thereon. Accordingly, instructions to withhold authority will have the same effect as a vote against such nominee.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION

OF EACH OF THE NOMINEES FOR DIRECTOR NAMED ABOVE.

10

PROPOSAL NO. 2 — APPROVAL OF AN AMENDMENT TO THE 2007 STOCK INCENTIVE PLAN AND RE-APPROVAL OF PERFORMANCE MEASURES AVAILABLE UNDER THE 2007 STOCK INCENTIVE PLAN

General

The Wintrust Financial Corporation 2007 Stock Incentive Plan was adopted by the Board of Directors on November 9, 2006 and became effective when it was approved by shareholders on January 9, 2007. The 2007 Plan was amended and restated by the Board of Directors as of October 22, 2007 and April 6, 2009 and approved by shareholders on May 28, 2009. In December 2010, the Compensation Committee of the Board of Directors amended the 2007 Plan to require a “double trigger” for the accelerated vesting of awards in the event of certain change of control transactions. At their meeting on April 11, 2011, the Compensation Committee recommended and the Board of Directors approved, subject to shareholder approval at the Annual Meeting, an amendment to the 2007 Plan (the “2007 Plan Amendment”) that would increase the number of shares authorized for issuance or delivery pursuant to awards granted under the 2007 Plan by 2,860,000 shares of the Company’s Common Stock.

In addition to the above-described change made by this amendment, the Company is also requesting that the Company’s shareholders reapprove the material terms of the performance measures for the 2007 Plan in accordance with Section 162(m) of the Code.

Purpose of the 2007 Plan

The 2007 Plan is intended to provide the Company with the ability to provide market-responsive, stock-based incentives and other rewards for employees and directors of the Company and its subsidiaries and consultants to the Company and its subsidiaries that (i) provide such employees, directors and consultants a stake in the growth of the Company and (ii) encourage them to continue in the service of the Company and its subsidiaries.

The 2007 Plan enhances our ability to link pay to performance and our ability to attract key employees to manage our banks and other businesses. The 2007 Plan also helps promote the retention of key employees while aligning their interests closely with those of our shareholders. Accordingly, management believes the ability to award equity incentives is an important component in continuing the Company’s growth.

History and Reason for Proposing the 2007 Plan Amendment

As noted above, the 2007 Plan was adopted by the Board of Directors on November 9, 2006 and became effective when it was approved by shareholders on January 9, 2007. As of March 31, 2011, only 97,800 shares of Common Stock remain available to be granted under the 2007 Plan. As of such date, 351,177 full value awards were outstanding and 1,920,054 options were outstanding. The outstanding options had a weighted average exercise price of $38.97 and a weighted average remaining term of 3.03 years. At current participation levels, we estimate that, in the absence of an amendment to increase the number of shares of Common Stock that may be offered under the 2007 Plan, such shares would be substantially exhausted during 2011. If the 2007 Plan Amendment is approved, the number of shares available to be granted in the future under the 2007 Plan will be increased from 97,800 to 2,957,800 shares. We believe that this increase in the number of shares available under the 2007 Plan will enable the Company to grant awards to eligible persons until approximately 2014.

In December 2010 the Compensation Committee amended the 2007 Plan to reflect what the Compensation Committee believes to be a best corporate governance practice, requiring a “double trigger” for the accelerated vesting of awards in the event of certain change of control transactions. This means that, effective for awards granted on or after January 1, 2011, equity awards will accelerate only if a participant is involuntarily terminated (other than for cause, death or disability) or, if permitted under the participant’s award agreement, terminates his or her own employment voluntarily for “good reason” within 18 months after the date of certain change of control transactions. In the case of a change of control transaction in which the awards are not effectively assumed by the surviving or acquiring corporation or the Common Stock does not otherwise remain outstanding following the change in control, the awards are still subject to “single trigger” vesting, meaning that the awards will accelerate upon the occurrence of such change of control transactions.

11

Key Features of the 2007 Plan

We believe that the following features of the 2007 Plan help assure that the 2007 Plan both provides incentives to our employees and protects shareholder value:

| • | | an independent body, the Compensation Committee, administers the 2007 Plan; |

|

| • | | the 2007 Plan counts each full-value award as 2.21 shares against the number of shares available for grant; |

|

| • | | the 2007 Plan limits unrestricted stock awards to an aggregate maximum of 25,000; |

|

| • | | the 2007 Plan prohibits repricing or repurchasing of stock option awards (or other material amendments) without prior shareholder approval; |

|

| • | | the 2007 Plan does not provide for the payment of dividends on unvested performance awards and does not allow discounted awards; and |

|

| • | | the 2007 Plan does not provide for liberal share counting or recycling of shares. |

Description of the 2007 Plan

The following is a description of the terms of the 2007 Plan. This description is qualified in its entirety by reference to the plan document, as proposed to be amended and restated, a copy of which is attached to this Proxy Statement as Annex A and incorporated herein by reference.

Shares Available. As noted above, 97,800 shares remain available as of March 31, 2011, and it is anticipated that substantially all available shares under the 2007 Plan will be awarded during 2011. If shareholders approve the 2007 Plan Amendment, a total of 2,957,800 shares would be available under the 2007 Plan, subject to adjustment in the event of certain changes to our capital structure. This represents an increase of 2,860,000 shares over the number of shares that would have been available in the absence of the 2007 Plan Amendment. In addition, each share awarded pursuant to a full value award (including an award of unrestricted stock) granted on or after the effective date of the 2007 Plan Amendment will be counted as 2.21 shares against the 2007 Plan’s share reserve. This effectively limits the number of full value awards that may be granted under the 2007 Plan because these awards would be counted against the 2007 Plan’s share reserve as 2.21 shares for every one share issued in connection with such awards.

Shares covered by an award granted under the 2007 Plan are not counted as used under the 2007 Plan unless and until they are actually issued and delivered to a participant. Consequently, in the event that an award granted under the 2007 Plan is ultimately paid in cash rather than shares, any shares that were covered by that award will remain available for issue or transfer under the 2007 Plan (in the same number as such shares were counted against the 2007 Plan’s share reserve). Notwithstanding anything to the contrary: (a) shares tendered in payment of the exercise price of an option will not be added to the aggregate plan limit described above; (b) shares withheld by the Company to satisfy tax withholding obligations will not be added to the aggregate plan limit described above; (c) shares that are repurchased by the Company with proceeds from option exercises will not be added to the aggregate plan limit described above; and (d) the full number of shares covered by a stock appreciation right, to the extent that it is exercised and settled in shares and whether or not shares are actually issued to the participant upon exercise of the right, will be considered issued or transferred pursuant to the 2007 Plan.

The shares of Common Stock subject to awards under the 2007 Plan and available for future awards may be reserved for issuance out of the Company’s total authorized but unissued shares or they may be shares held in treasury or acquired by the Company on the open market. A participant in the 2007 Plan is permitted to receive multiple grants of stock-based awards. The terms and provisions of a type of award with respect to any recipient need not be the same with respect to any other recipient of such award. The 2007 Plan provides that during any calendar year the maximum number of shares of Common Stock which may be made subject to awards granted to any single participant may not exceed 100,000.

12

Administration. The 2007 Plan provides that it shall be administered by a committee of the Board of Directors, constituted so as to permit the 2007 Plan to comply with the “non-employee director” provisions of Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the “outside director” requirements of Section 162(m) of the Code (see “Re-approval of Section 162(m) Performance Measures” below). The Board of Directors of the Company has delegated the administration of the 2007 Plan to its Compensation Committee. The Compensation Committee makes determinations with respect to the participation of employees, directors and consultants in the 2007 Plan and, except as otherwise required by law or the 2007 Plan, the grant terms of awards including vesting schedules, price, length of relevant performance, restriction or option periods, dividend rights, post-retirement and termination rights, payment alternatives, and such other terms and conditions as the Compensation Committee deems appropriate. Such grant terms are set forth in a written award agreement. The Compensation Committee also has final, binding authority to interpret and construe the provisions of the 2007 Plan and the award agreements. The Compensation Committee may designate other persons (so long as such persons are independent) to carry out its responsibilities under such conditions and limitations as it may set, other than its authority with regard to awards granted to employees who are executive officers or directors of the Company (including those individuals whose compensation is subject to the limit under Section 162(m) of the Code, as further described below in “Re-approval of Section 162(m) Performance Measures”).

Awards. The following types of awards may be granted under the 2007 Plan:

Stock Options. Stock options may be granted in the form of incentive stock options within the meaning of Section 422 of the Code or stock options not meeting such Code definition (“nonqualified stock options”). The 2007 Plan permits all of the shares available under the 2007 Plan to be awarded in the form of incentive stock options if the Compensation Committee so determines. The exercise period for any stock option will be determined by the Compensation Committee at the time of grant which may provide that options may be exercisable in installments. The exercise price per share of Common Stock of any option may not be less than the fair market value of a share of Common Stock on the date of grant. Each stock option may be exercised in whole, at any time, or in part, from time to time, after the grant becomes exercisable. The Compensation Committee may provide for the exercise price to be payable in cash, in shares of already owned Common Stock, in any combination of cash and shares, pursuant to a broker-assisted cashless exercise program, or by such methods as the Compensation Committee may deem appropriate, including but not limited to loans by the Company on such terms and conditions as the Compensation Committee may determine.

Stock Appreciation Rights. Stock appreciation rights (“SARs”) may be granted independently of any stock option or in tandem with all or any part of a stock option granted under the 2007 Plan, upon such terms and conditions as the Compensation Committee may determine. Upon exercise, a SAR entitles a participant to receive the excess of the fair market value of a share of Common Stock on the date the SAR is exercised over the fair market value of a share of Common Stock on the date the SAR is granted. The Compensation Committee will determine whether a SAR will be settled in cash, Common Stock or a combination of cash and Common Stock. Upon exercise of a SAR granted in conjunction with a stock option, the option or the portion thereof to which the SAR relates will be surrendered.

Restricted Shares. Restricted shares are shares of Common Stock that may not be sold or otherwise disposed of during a restricted period after grant, the duration of which will be determined by the Compensation Committee. The Compensation Committee may provide for the lapse of such restrictions in installments. Restricted shares may be voted by the recipient. Dividends on the restricted shares may be payable to the recipient in cash or in additional restricted shares. A recipient of a grant of restricted shares will generally earn unrestricted ownership thereof only if the individual is continuously employed by the Company or a subsidiary during the entire restricted period.

Performance Shares. Performance shares are grants of shares of Common Stock which are earned by achievement of performance measures established for the award by the Compensation Committee. During the applicable performance period determined by the Compensation Committee for an award, the shares may be voted by the recipient and the recipient is also entitled to receive dividends thereon unless the Compensation Committee determines otherwise. If the applicable performance criteria are met, at the end of the applicable performance period, the shares are earned and become unrestricted. The

13

Compensation Committee may provide that a certain percentage of the number of shares originally awarded may be earned based upon the attainment of the performance measures.

Restricted and Performance Share Units. Share units are fixed or variable share or dollar denominated units valued, at the Compensation Committee’s discretion, in whole or in part by reference to, or otherwise based on, the fair market value of the Company’s Common Stock. The Compensation Committee will determine the terms and conditions applicable to share units, including any applicable restrictions, conditions or contingencies, which may be related to individual, corporate or other categories of performance. A share unit may be payable in Common Stock, cash or a combination of both.

Other Incentive Awards. The Compensation Committee may grant other types of awards of Common Stock or awards based in whole or in part by reference to Common Stock (“Other Incentive Awards”). The Compensation Committee will determine the time at which grants of such Other Incentive Awards are to be made, the size of such awards and all other conditions of such awards, including any restrictions, deferral periods or performance requirements.

The disposition of an award in the event of the retirement, disability, death or other termination of a participant’s employment or service shall be as determined by the Compensation Committee as set forth in the award agreement.

Except to the extent permitted by the specific terms of any nonqualified stock options, no award will be assignable or transferable except by will, the laws of descent and distribution or the beneficiary designation procedures under the 2007 Plan.

Minimum Vesting and Restricted Period. Each award agreement will contain a requirement that (i) no stock option award or grant of restricted shares that is not performance-based may become fully exercisable prior to the third anniversary of the date of grant, and to the extent such an award provides for vesting in installments over a period of no less than three years, such vesting shall occur no more rapidly than ratably on each of the first three anniversaries of the date of grant and (ii) no performance-based award may become fully exercisable or saleable prior to the first anniversary of the date of grant; except that, in each case, such minimum vesting restrictions (A) may not apply when employment terminates as a result of death, disability, retirement, layoff or divestiture and (B) will not apply to awards for newly hired employees or employees who subsequently retire or have plans for retirement, or awards in connection with acquisitions or in lieu of cash bonuses.

Term of Awards. The maximum term of unvested or unexercised awards is seven years after the initial date of grant.

Adjustments. If the number of issued shares of Common Stock increases or decreases as a result of certain stock splits, capital adjustments, stock dividends or otherwise, without the receipt of consideration by the Company, then the aggregate number of shares as to which awards may be granted, the limit on the number of shares that may be awarded to a single participant each year, the number of shares covered by each outstanding award and the price per share of Common Stock in each such award will be adjusted proportionately. The Compensation Committee may also adjust such amounts and make certain other changes in the event of any other reorganization, recapitalization, merger, consolidation, spinoff, extraordinary dividend or other distribution or similar transaction.

Change of Control. The Company will undergo a change of control in the event of certain acquisitions of 50% or more of the Company’s Common Stock, a change in the majority of the Board of Directors, or the consummation of a reorganization, merger or consolidation (unless, among other conditions, the Company’s shareholders receive more than 50% of the stock of the surviving company), a sale or disposition of all or substantially all of the assets of the Company, or a complete liquidation or dissolution of the Company. With respect to awards granted prior to January 1, 2011 and, with respect to all awards, in the case of change of control events in which the awards are not effectively assumed by the surviving or acquiring corporation or the Common Stock does not otherwise remain outstanding, then, upon such change of control, all options and SARs outstanding shall become immediately exercisable and remain exercisable for the remainder of their term, all restrictions on restricted shares will lapse, all restricted share units will become fully vested and, unless otherwise specified in a participant’s award agreement, all performance measures applicable to any awards shall be deemed attained at the maximum payment

14

level. In addition, the Board of Directors (as constituted before the change of control) may, in its sole discretion, require outstanding awards, in whole or in part, to be cancelled, and to provide for the holder to receive a cash payment (or shares in the resulting corporation or its parent corporation) in an amount (or having a value) equal to (a) in the case of a stock option or stock appreciation right, the number of shares then subject to the portion of such award cancelled multiplied by the excess, if any, of the highest per share price offered to holders of Common Stock in the change of control transaction, over the purchase price or base price per share subject to the award and (b) in the case of restricted shares, restricted share units, performance shares, performance share units or Other Incentive Awards, the number of shares of Common Stock or units then subject to the portion of such award cancelled multiplied by the highest per share price offered to holders of Common Stock in the change of control transaction.

With respect to awards granted on or after January 1, 2011, in the event of the termination of a participant’s employment by the Company without “cause” or, to the extent permitted in the award agreement, the termination of a participant’s employment by the participant for “good reason,” in each case, within the 18 month period following the occurrence of a change of control in which the outstanding awards were effectively assumed or otherwise remained outstanding, then, upon such termination of employment, all options and SARs outstanding shall become immediately exercisable and remain exercisable for the remainder of their term, all restrictions on restricted shares will lapse, all restricted share units will become fully vested and, unless otherwise specified in a participant’s award agreement, all performance measures applicable to any awards shall be deemed attained at the maximum payment level.

Amendments and Termination. The Board of Directors may at any time suspend or terminate the 2007 Plan. The Board of Directors may amend the 2007 Plan at any time, subject to any requirement of shareholder approval imposed by applicable law, rule or regulation; provided, however, that any material amendment to the 2007 Plan will not be effective unless approved by the Company’s shareholders. For this purpose, a material amendment is any amendment that would:

| • | | materially increase the number of shares available under the 2007 Plan or issuable to a participant, except in connection with an event described above in “Adjustments;” |

|

| • | | change the types of awards that may be granted under the 2007 Plan; |

|

| • | | expand the class of persons eligible to receive awards or otherwise participate in the 2007 Plan; or |

|

| • | | reduce the price at which an option is exercisable either by amendment of an award agreement or by substitution of a new option at a reduced price, except in connection with an event described above in “Adjustments.” |

No amendment, suspension or termination may adversely affect in any material way any awards previously granted thereunder without such award holder’s written consent. There is no set termination date for the 2007 Plan, although no incentive stock options may be granted more than 10 years after the effective date of the 2007 Plan.

Re-approval of Section 162(m) Performance Measures

In general, Section 162(m) of the Code disallows federal income tax deductions for certain compensation in excess of $1,000,000 per year paid to each of the Company’s Chief Executive Officer and its other three most highly compensated executive officers other than the Chief Financial Officer. Normally, under Section 162(m), compensation that qualifies as “performance-based compensation” is not subject to the $1,000,000 limit. To qualify certain incentive awards as “performance-based compensation,” the following requirements must be satisfied: (i) the performance measures are determined by a committee consisting solely of two or more “outside directors,” (ii) the material terms under which the compensation is to be paid, including the performance measures, are approved by the shareholders of the Company and (iii) if applicable, the committee certifies that the applicable performance measures were satisfied before any payment of performance-based compensation is made. Our shareholders are being asked to reapprove the material terms of the performance measures for the 2007 Plan in accordance with Section 162(m) of the Code, which is required every five years.

Eligible Employees.Employees, directors and consultants of the Company or any subsidiary are eligible to participate in the 2007 Plan. As of March 31, 2011, there were 378 participating employees, no participating directors, other than Mr. Wehmer who is included as a participating employee, and 13 participating consultants.

15

Award Limits.The 2007 Plan provides that during any calendar year the maximum number of shares of Common Stock which may be made subject to awards to any single participant may not exceed 100,000.

Performance Measures.Performance criteria may be measured in absolute terms or measured against, or in relationship to, other companies comparably, similarly or otherwise situated and may be based on, or adjusted for, other objective goals, events, or occurrences established by the Compensation Committee for a performance period, but must relate to one or more of the following: earnings, earnings growth, revenues, expenses, stock price, market share, charge-offs, loan loss reserves, reductions in non-performing assets, return on assets, return on equity, return on investment, regulatory compliance, satisfactory internal or external audits, improvements in financial ratings, achievement of balance sheet or income statement objectives, extraordinary charges, losses from discontinued operations, restatements and accounting changes and other unplanned special charges such as restructuring expenses, acquisition expenses including goodwill, unplanned stock offerings and unplanned loan loss provisions. Such performance measures may be particular to a line of business, subsidiary or other unit or may be based on the performance of the Company generally.

If the shareholders approve the proposal, performance-based awards can continue to be granted under the 2007 Plan. If the shareholders do not approve the material terms of the performance measures for the 2007 Plan, the Compensation Committee will review our executive compensation program and the granting of performance-based awards in light of such vote and the principles described in the section entitled “Compensation Discussion and Analysis”.

Stock Option Awards under the 2007 Plan Table

The following table sets forth the number of stock options that have been granted to the listed individuals or groups under the 2007 Plan since its inception until March 31, 2011. For grants awarded to our named executive officers in 2010, please see “Executive Compensation-2010 Grants of Plan-Based Awards Table.” Any other future awards to be received by an individual or group under the 2007 Plan are not fully determinable at this time and will depend on individual and corporate performance and other determinations to be made by the Compensation Committee.

Stock Option Awards under the 2007 Plan Table

| | | | |

Name and Position | | Stock Options |

Edward J. Wehmer-President & Chief Executive Officer | | | 9,000 | |

David A. Dykstra-Senior Executive Vice President & Chief Operating Officer | | | 8,000 | |

Richard B. Murphy-Executive Vice President & Chief Credit Officer | | | 6,500 | |

David L. Stoehr-Executive Vice President & Chief Financial Officer | | | — | |

Leona A. Gleason-Executive Vice President — Chief Administrative Officer | | | 10,000 | |

All Current Executive Officers (Including the Officers Named Above) | | | 43,500 | |

All Current Directors Who Are Not Executive Officers | | | — | |

All Employees (Other Than Current Executive Officers) | | | 286,315 | |

On April 21, 2011, the closing sale price of the Company’s Common Stock, as reported on the Nasdaq Global Select Market (“Nasdaq”), was $34.56 per share.

16

Federal Income Tax Consequences

The following discussion briefly summarizes certain U.S. federal income tax consequences generally arising with respect to awards under the 2007 Plan. The discussion is based upon current interpretations of the Code, and the regulations promulgated thereunder as of such date. To the extent a participant recognizes ordinary income in any event described below, such amount is subject to income tax withholding if the participant is an employee.

Nonqualified Stock Options. For U.S. federal income tax purposes, no income is recognized by a participant upon the grant of a nonqualified stock option under the 2007 Plan. Upon the exercise of a nonqualified option, compensation taxable as ordinary income will be realized by the participant in an amount equal to the excess of the fair market value of a share of Common Stock on the date of such exercise over the exercise price. A subsequent sale or exchange of such shares will result in gain or loss measured by the difference between (a) the exercise price, increased by any compensation reported upon the participant’s exercise of the option and (b) the amount realized on such sale or exchange. Such gain or loss will be capital in nature if the shares were held as a capital asset and will be long-term if such shares were held for more than one year.

Incentive Stock Options. Except as otherwise described below, no income is recognized by a participant upon the grant of an incentive stock option under the 2007 Plan. No taxable income is realized by the participant pursuant to the exercise of an incentive stock option granted under the 2007 Plan, and if no disqualifying disposition of such shares is made by such participant within two years after the date of grant or within one year after the transfer of such shares to such participant, then (a) upon the sale of such shares, any amount realized in excess of the option price will be taxed to such participant as a long-term capital gain and any loss sustained will be a long-term capital loss, and (b) no deduction will be allowed to the Company for U.S. federal income tax purposes. Upon exercise of an incentive stock option, the participant may be subject to alternative minimum tax with respect to the excess (if any) of the fair market value of the shares purchased (determined as of the date of exercise) over the option price.

If the shares of Common Stock acquired upon the exercise of an incentive stock option are disposed of prior to the expiration of the holding period described above, generally (a) the participant will realize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of the shares at the time of exercise (or, if less, the amount realized on the disposition of the shares) over the option price thereof, and (b) the Company will be entitled to deduct such amount. Any further gain or loss realized will be taxed as short-term or long-term capital gain or loss, as the case may be, and will not result in any deduction by the Company.

If an incentive stock option is exercised at a time when it no longer qualifies as an incentive stock option, the option is treated as a nonqualified stock option.

Stock Appreciation Rights. No taxable income is recognized by a participant upon the grant of a SAR under the 2007 Plan. Upon the exercise of a SAR, however, compensation taxable as ordinary income will be realized by the participant in an amount equal to the cash received upon exercise, plus the fair market value on the date of exercise of any shares of Common Stock received upon exercise. Shares of Common Stock received on the exercise of a SAR will be eligible for capital gain treatment, with the capital gain holding period commencing on the day after the date of exercise of the SAR.

Restricted and Performance Shares. A recipient of restricted shares or performance shares generally will be subject to tax at ordinary income rates on the fair market value of the Common Stock at the time the restricted shares or performance shares vest or are no longer subject to forfeiture. However, a recipient who so elects under Section 83(b) of the Code within 30 days of the date of the grant will recognize ordinary taxable income on the date of the grant equal to the fair market value of the restricted shares or performance shares on the date of grant as if the restricted shares were unrestricted or the performance shares were earned and could be sold immediately. If the shares subject to such election are forfeited, the recipient will not be entitled to any deduction, refund or loss for tax purposes with respect to the forfeited shares. Upon sale of the restricted shares or performance shares after vesting or after the forfeiture period has expired, the holding period to determine whether the recipient has long-term or short-term capital gain or loss begins when the restriction period expires. However, if the recipient timely elects to be taxed as of the date of the grant, the holding period commences on the day after the date of the grant and the tax

17

basis will be equal to the fair market value of the shares on the date of the grant as if the shares were then unrestricted and could be sold immediately. A participant receiving dividends with respect to restricted shares or performance shares for which the above-described election has not been made and prior to the time the restrictions lapse will recognize compensation taxable as ordinary income, rather than dividend income, in an amount equal to the dividends paid.

The amount of ordinary income recognized upon the lapse of restrictions or by making the above-described election is deductible by the Company as compensation expense, except to the extent the deduction limits of Section 162(m) of the Code apply.

Restricted and Performance Share Units. A recipient of restricted or performance share units will generally be subject to tax at ordinary income rates on the fair market value of any Common Stock issued pursuant to such an award. The fair market value of any Common Stock received will generally be included in income at the time of receipt. The capital gain or loss holding period for any Common Stock distributed under an award will begin on the day after the date of such distribution. The amount of ordinary income recognized is deductible by the Company as compensation expense, except to the extent the deduction limits of Section 162(m) of the Code apply.

Other Incentive Awards. The federal income tax consequences of Other Incentive Awards will depend on how such awards are structured. Generally, the Company will be entitled to a deduction with respect to such awards only to the extent that the recipient realizes compensation income in connection with such awards and only to the extent not subject to the deduction limits of Section 162(m) of the Code. It is anticipated that Other Incentive Awards will usually result in compensation income to the recipient in some amount. However, some forms of Other Incentive Awards may not result in any compensation income to the recipient or any income tax deduction for the Company.

The approval of the amendment to the 2007 Plan and the re-approval of the performance measures available under the 2007 Plan requires the affirmative vote of a majority of the shares of Common Stock represented at the Annual Meeting, in person or by proxy, and entitled to vote thereon.

THE BOARD OF DIRECTORS RECOMMENDS SHAREHOLDERS VOTE “FOR” APPROVAL OF THE AMENDMENT TO THE WINTRUST FINANCIAL CORPORATION 2007 STOCK INCENTIVE PLAN AND THE RE-APPROVAL OF THE PERFORMANCE MEASURES AVAILABLE UNDER THE 2007 PLAN

18

PROPOSAL NO. 3 — ADVISORY VOTE ON 2010 EXECUTIVE COMPENSATION

Background of the Proposal

As the Company has done in years past, we are providing shareholders with an opportunity to vote to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement. The Company believes that it is appropriate to seek the views of shareholders on the design and effectiveness of the Company’s executive compensation program. At the 2010 annual meeting of shareholders, the advisory vote on executive compensation received approximately 95% support from shareholders.

Executive Compensation

The Company believes that its compensation policies and procedures, which are reviewed and approved by the Compensation Committee, encourage a culture of pay for performance and are strongly aligned with the long-term interests of shareholders. As more fully set forth under “Executive Compensation — Compensation Discussion and Analysis,” the Compensation Committee has taken a number of actions in recent years to further strengthen the Company’s compensation philosophy and objectives. As always, the Compensation Committee will continue to review all elements of the executive compensation program and take any steps it deems necessary to continue to fulfill the objectives of the program.

Shareholders are encouraged to carefully review the “Executive Compensation” section of this Proxy Statement for a detailed discussion of the Company’s executive compensation program.

As required by the Exchange Act and the guidance provided by the Securities and Exchange Commission (the “SEC”), the Board of Directors has authorized a shareholder vote on the Company’s 2010 executive compensation as reflected in the Compensation Discussion and Analysis, the disclosures regarding named executive officer compensation provided in the various tables included in this Proxy Statement, the accompanying narrative disclosures and the other compensation information provided in this Proxy Statement. This proposal, commonly known as a “Say on Pay” proposal, gives the Company’s shareholders the opportunity to endorse or not endorse the Company’s executive pay program and policies through the following resolution:

“Resolved, that the shareholders of Wintrust Financial Corporation approve the compensation of executives, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation discussion and analysis, the compensation tables and any related material disclosed in this Proxy Statement for the 2011 Annual Meeting of Shareholders.”

Required Vote

The approval of the advisory (non-binding) proposal on our 2010 executive compensation described in this Proxy Statement requires the affirmative vote of a majority of the shares of Common Stock represented at the Annual Meeting, in person or by proxy, and entitled to vote thereon. Abstentions will have the same effect as a vote against the proposal. Because this shareholder vote is advisory, it will not be binding on the Board of Directors. However, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

THE BOARD OF DIRECTORS RECOMMENDS SHAREHOLDERS VOTE “FOR”

APPROVAL OF THE ADVISORY PROPOSAL ON 2010 EXECUTIVE COMPENSATION

AS DESCRIBED IN THIS PROXY STATEMENT

19

PROPOSAL NO. 4 — ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION

Background of the Proposal

At least once every three years, the Company will provide shareholders with an opportunity to vote to approve, on an advisory basis, the Say on Pay vote as described in the previous proposal. Pursuant to recently enacted Section 14A of the Exchange Act, we are asking shareholders whether future Say on Pay votes should be held every one, two or three years.

Frequency of Say on Pay Advisory Vote

After careful consideration, our Board of Directors recommends that shareholders vote for holding a Say on Pay vote EVERY YEAR for a number of reasons, including the following:

| • | | An annual Say on Pay vote will allow us to obtain shareholder input on our executive compensation program on a more consistent basis which aligns more closely with our objective to engage in regular dialogue with our shareholders on corporate governance matters, including our executive compensation philosophy, policies and practices; |

|

| • | | A one-year frequency provides the highest level of accountability and communication by enabling the Say on Pay vote to correspond with the most recent executive compensation information presented in our proxy statement for the annual meeting; |

|

| • | | A longer approach may make it more difficult for the Compensation Committee to understand and respond to the voting results because it may be unclear whether the shareholder vote pertains to the most recent executive compensation information presented in our proxy statement or to pay practices from the previous two years or both; and |

|

| • | | Holding Say on Pay votes annually reflects sound corporate governance principles and is consistent with a majority of institutional investor policies. |

Shareholders are not voting to approve or disapprove of the Board’s recommendation. Instead, the proxy card provides shareholders with four choices with respect to this proposal: one year, two years, three years or shareholders may abstain from voting on the proposal. For the reasons discussed above, we are asking our shareholders to vote for a ONE YEAR frequency when voting in response to the following resolution at the Annual Meeting:

“Resolved, that the option of once every (1) one year, (2) two years or (3) three years that receives the highest number of votes cast for this resolution will be determined to be the preferred frequency with which the Company is to hold a shareholder vote to approve the compensation of the named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation discussion and analysis, the compensation tables and any related material disclosed in the proxy statement for the annual meeting of shareholders.”

Required Vote

This vote is an advisory vote only, and therefore it will not bind the Company or our Board of Directors. However, the Board of Directors and the Compensation Committee will consider the voting results as appropriate when adopting a policy on the frequency of future Say on Pay votes. The option of one year, two years or three years that receives the highest number of votes cast by shareholders will be considered by the Board of Directors as the shareholders’ recommendation as to the frequency of future Say on Pay votes. Nevertheless, the Board may decide that it is in the best interests of our shareholders and the Company to hold Say on Pay votes more or less frequently than the option approved by our shareholders.

THE BOARD OF DIRECTORS RECOMMENDS SHAREHOLDERS VOTE FOR

APPROVAL OF THE ADVISORY PROPOSAL TO HOLD A SAY ON PAY VOTE EVERY YEAR.

20

BOARD OF DIRECTORS, COMMITTEES AND GOVERNANCE

Board of Directors

Overview